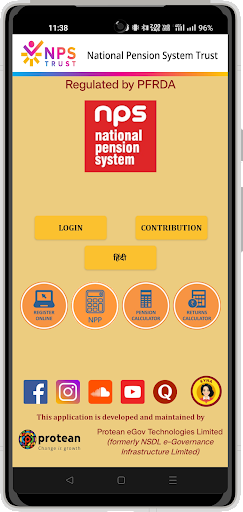

NPS by Protean (NSDL e-Gov)

Description

The new APP gives your details of Subscribers account online. The Subscriber can access latest account details as is available on the CRA web site using user ID (PRAN) and password. The APP access your account details online and provides you with user friendly interface to browse through your account information. It also enables you to maintain your latest contact details and password.

The APP gives better user experience and provides additional functionality such as

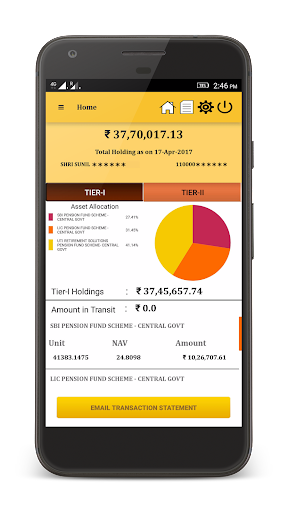

1. View current holdings

2. Request for Transaction Statement for the year on your email ID.

3. Submit Contribution for Tier I / Tier II

4. Change Scheme Preference

5. Initiate withdrawal from Tier II account

6. View your Account details.

7. Download e-PRAN

8. Inquiry/ raise Grievance

9. View Last 5 contribution transactions carried out

10. Change contact details like Telephone, Mobile no. and email ID.

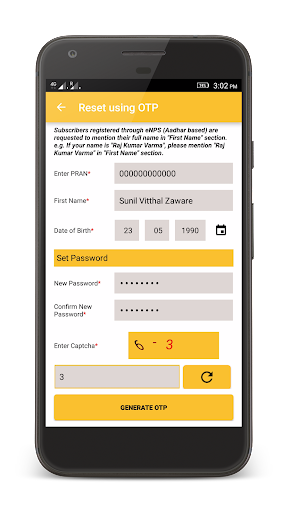

11. Change your Password / Secret Question

12. Regenerate password using secret Question/ OTP

13. Get notifications related to NPS.

NPS, an abbreviation for National Pension System, is a government-backed pension scheme launched by the Government of India to provide old age income security to all Indian citizens. It is managed by the Pension Fund Regulatory and Development Authority (PFRDA) and implemented through various pension fund managers (PFMs).

Key Features:

* Tax Benefits: NPS offers tax benefits under Section 80CCD (1) and Section 80CCD (1B) of the Income Tax Act, 1961. Contributions made to NPS are eligible for tax deductions up to a certain limit.

* Government Contribution: The government contributes 10% of the basic salary plus dearness allowance to the NPS account of its employees.

* Choice of Investment Options: NPS provides various investment options to choose from, including equity funds, corporate debt funds, government securities, and alternative investment funds.

* Flexible Contribution: Subscribers can choose to contribute a fixed amount or a percentage of their salary to their NPS account.

* Portability: NPS accounts are portable, allowing subscribers to transfer their funds to a new PFM or location without losing any benefits.

* Multiple Withdrawal Options: Subscribers can withdraw a portion of their NPS funds at specific intervals or upon retirement.

* Risk Management: NPS offers risk management options such as auto-choice and lifecycle funds, which adjust the investment allocation based on the subscriber's age and risk profile.

Eligibility:

NPS is open to all Indian citizens between the ages of 18 and 65 years. There are two types of NPS accounts: Tier I and Tier II. Tier I accounts are primarily for retirement savings, while Tier II accounts are for additional voluntary savings.

Contribution Limits:

The minimum annual contribution for Tier I accounts is Rs. 1,000, while the maximum contribution limit is 10% of the subscriber's basic salary plus dearness allowance. There is no minimum contribution limit for Tier II accounts, but the maximum contribution limit is Rs. 1.5 lakh per financial year.

Investment Options:

NPS offers a wide range of investment options to cater to different risk appetites and financial goals. These options include:

* Equity Funds: Invest primarily in equity markets and offer the potential for higher returns but also carry higher risk.

* Corporate Debt Funds: Invest in corporate bonds and offer lower returns than equity funds but also carry lower risk.

* Government Securities: Invest in government-issued bonds and offer the lowest returns but also the lowest risk.

* Alternative Investment Funds: Invest in a combination of assets such as real estate, infrastructure, and private equity.

Withdrawal Options:

Subscribers can withdraw a portion of their NPS funds at specific intervals or upon retirement. The following withdrawal options are available:

* Partial Withdrawal: Subscribers can withdraw up to 25% of their accumulated corpus after three years of account opening.

* Annuity Purchase: Subscribers can use a portion of their accumulated corpus to purchase an annuity, which provides a regular income stream during retirement.

* Lump Sum Withdrawal: Subscribers can withdraw the remaining corpus upon retirement or at the age of 60 years.

Information

Version

14.0.30

Release date

Jun 20 2016

File size

9.5 MB

Category

Business

Requires Android

9 and up

Developer

Protean eGov Technologies Ltd.

Installs

5M+

ID

nps.nps

Available on

Related Articles

-

"Jedi 2" sharing of scientific achievements with quantity and achievement strategy

There are many achievements in "Jedi 2", and some achievement requirements are quite unique, such as "science wins by quantity". The achievement requirements are to carry at least 15 ordinary samples and evacuate. You must take samples from the earth, otherwise it does not count. In addition, if a team has a total of 15 public samples, or someone in the team holds all 15 public samples, it will not be counted. Jedi Soldier 2 How to do science win by quantity? Carry at least 15 ordinary samples to evacuate if a team has 15 public samples in total, or someone in the team holds all 15 public samples, it is not counted in1 READS

Jun 17 2025

-

"Jedi 2" The higher they are, the better they achieve, the more they achieve.

There are many achievements in "Jidi 2", and some achievement requirements are quite unique, such as "the higher they are..." The achievement requirements are to defeat a titan. First, the titan appears in the challenge (4) difficulty and difficulty (5) difficulty in certain types of tasks, but will begin to appear in all types of tasks from extreme (6) difficulty and higher difficulty. Jedi Soldier 2 The higher they are, the more they are, how to do it, the higher they are. Defeat a titan. First, the titan appears in the challenge (4) difficulty and difficulty (5) difficulty in some types of tasks, but will start to appear in all types of tasks from the extreme1 READS

Jun 17 2025

-

Introduction to the skills of fighting giant sabotage in "Jedi 2"

There are many robots in "Jidi 2", and the Giant Destroyer is one of them. If you want to fight the Giant Destroyer, you must know some skills. First of all, the Giant Destroyer can be hit by most of the sub-type weapons and killed instantly. The Assault Soldier can destroy the Giant Destroyer at a very long distance through guidance by sniping the radiator on its back. How can the giant destroyer of Jedi Soldier 2 be used to fight a refrigerator that looks a bit like the Warhammer next door? Fortunately, it is fully automatic, so you don’t have to worry about getting up. Giant destroyers are the perfect product that combines "health", "firepower" and "speed", and they will only appear above the challenge difficulty. huge1 READS

Jun 17 2025

-

"Jedi 2" Even if it's a draw, the achievement strategy sharing

There are many achievements in "Jidi 2", and some achievement requirements are quite unique, such as "Just draw". The achievement requirements are to shoot down the giant's arms and evacuate when it is still alive. The mechanical giant first appears in a specific type of task of medium (3) difficulty, but in all types of tasks that challenge (4) difficulty and higher difficulty. Jedi Soldier 2, even if the draw is tied, what to do, even if the achievement is tied. Shoot the giant's two arms and evacuate when it is still alive. The mechanical giant first appears in a specific type of mission of medium (3) difficulty, but in challenge (4) difficulty and higher1 READS

Jun 17 2025