MoneyFy

Description

Simplify investing with Moneyfy. Tata Capital’s Moneyfy App has a simple interface and secure data, making Moneyfy one of the best investment apps. Whether you’re making a one-time investment or a Systematic Investment Plan (SIP), enjoy a hassle-free 100% digital interface with just a few taps.

Fed up with complicated online investment apps? Moneyfy is here to make your life easier. No more confusing jargon – we've made it a super simple investment app for you.

Overview

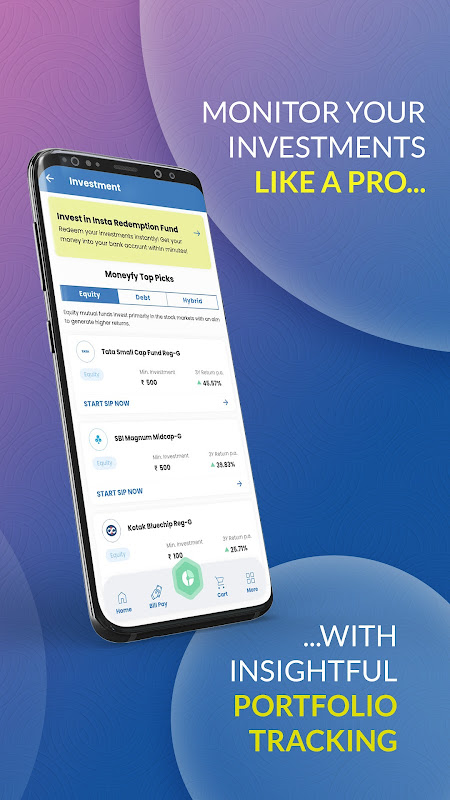

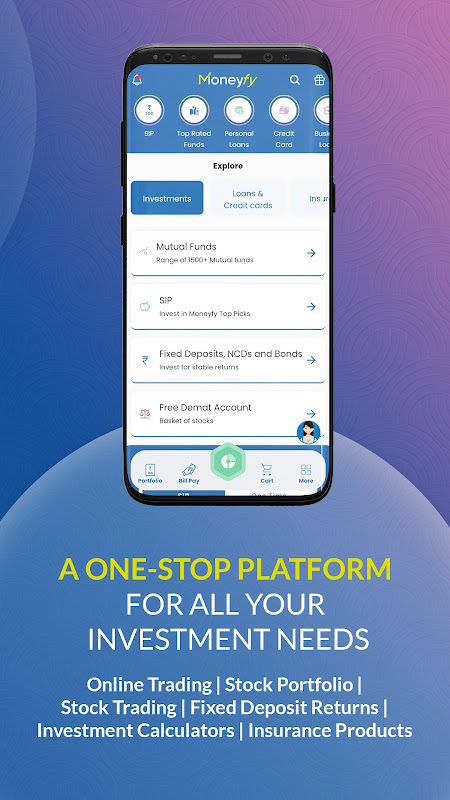

Moneyfy by Tata Capital is your complete online investment app. Invest in Mutual funds and SIPs that match your risk tolerance and financial needs. Moneyfy lets you compare, assess, and track performance for hand-picked schemes. Also, never miss a due date and pay bills on the go!

✅Want to make your money grow? 💹

Explore a curated selection of top-performing mutual funds (backed by Morning Star & Value Research ratings) & invest with confidence. You can also diversify by investing in corporate FDs & stocks.

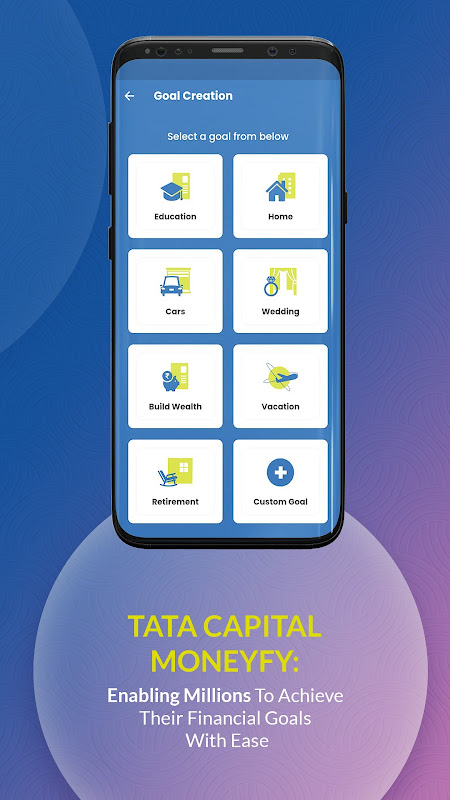

Moneyfy offers goal-based tools to help beginners maximise returns. Start investing in MF’s and SIPs with expert guidance on the Moneyfy App.

You can invest in all types of mutual funds and SIPs, such as:

👍 Equity funds

👍 Hybrid funds

👍 Debt funds

👍 ELSS Mf

✅ SIPs on your mind? Here’s the ultimate mutual fund and SIP app.

Easily manage MFs and SIPs from a single dashboard. Systematic withdrawal lets you earn frequently. If you haven't tried the SIP calculator yet, do so now and customise your investments to long-term goals.

Why Moneyfy?

Over 1,000,000+ Users Trust Moneyfy.

Moneyfy offers comparison & scanner tools, auto-pay, & a portfolio dashboard to start your investing journey.

• Responsive and intuitive UI

• Beginner-friendly

• Manage all your finances on a single platform - lumpsum investments, loans, credit cards, MF’s, SIPs, Fixed deposits, and more.

• View, modify, and manage your portfolio- anytime, anywhere!

• Your financial details are safe with us

• Customer support for all your queries

✅Need a loan? 💰

No worries. Moneyfy simplifies credit applications. Forget the tough process of paperwork & long approval times! Get quick online credit with flexible eligibility & low interest rates. Through this app, you can avail:

● Instant online loans

● Personal loan

● Home loan

● Business loan

Download the app now and take control of your financial future. With just a few taps, you can start your journey towards financial freedom!

Personal Loans:

Tenures from 61 days to 84 months

Attractive Interest Rates from 10.99% to 85% APR (Annual Percentage Rate)

Use the EMI calculator to simplify your EMI payments.

Example of repayment calculation for a personal loan:

Amount - Rs. 5 Lakhs

Tenure - 2 Years

Interest Rate - 14%

Processing Fee - 2%

Monthly EMI = Rs. 24,006

Total repayment (Principal + Interest + Fees) = Rs. 5,86,155

NBFC Partners:

Tata Capital Limited.

Bhanix Finance and Investment Limited (CASHe)

Earlysalary Services Private Limited (Fibe)

Krazybee Services Private Limited (Kreditbee)

Loantap Credit Products Private Limited (LoanTap)

Mpokket Financial Services Private Limited (mPokket)

AMC partners:

Tata Mutual fund

ICICI Prudential Mutual fund

Quant Mutual fund

HDFC Mutual fund

Axis mutual fund

PPFAS Mutual fund

Mirae Mutual fund

SBI mutual fund

Kotak Mutual fund

Motilal Oswal Mutual fund

Have queries?

Visit: https://www.tatacapital.com/moneyfy

⚠Mutual Fund and SIP Investments are Subject to Market Risks. Please read all scheme-related documents carefully before investing.

Office Address:

11th Floor, Tower A, Peninsula Business Park, Ganpatrao Kadam Marg, Lower Parel, Mumbai - 400013.

Overview

Moneyfy is a financial management app that helps users track their expenses, create budgets, and achieve their financial goals. It offers a user-friendly interface, advanced budgeting tools, and personalized insights to empower users to take control of their finances.

Features

* Expense Tracking: Moneyfy allows users to effortlessly record their expenses in real-time. They can categorize expenses, add notes, and attach receipts for accurate tracking.

* Budgeting: The app provides robust budgeting features to help users plan their finances. Users can create multiple budgets, set spending limits, and track their progress against their goals.

* Financial Insights: Moneyfy analyzes user spending patterns and provides personalized insights. It identifies areas where users can save money, improve their cash flow, and optimize their financial decisions.

* Synchronization: Moneyfy seamlessly synchronizes across devices, ensuring that users have access to their financial data anytime, anywhere.

* Security: The app employs industry-leading security measures to protect user data. It uses encryption, two-factor authentication, and regular security updates to ensure the confidentiality and integrity of financial information.

Benefits

* Improved Financial Awareness: Moneyfy empowers users to gain a comprehensive understanding of their financial situation by providing a clear overview of their expenses and income.

* Effective Budgeting: The advanced budgeting tools help users create realistic budgets, stick to their plans, and avoid overspending.

* Personalized Insights: The app's tailored insights enable users to identify opportunities for savings, improve their financial habits, and make informed financial decisions.

* Time Savings: Moneyfy automates expense tracking and budgeting, freeing up users' time to focus on other important tasks.

* Increased Control: The app gives users a sense of control over their finances, allowing them to make proactive decisions and achieve their financial goals.

Pricing

Moneyfy offers both a free and a premium subscription. The premium subscription unlocks additional features such as advanced budgeting tools, detailed financial reports, and personalized financial coaching.

Conclusion

Moneyfy is an invaluable financial management tool that empowers users to take control of their finances. Its user-friendly interface, comprehensive features, and personalized insights make it an ideal solution for individuals looking to improve their financial well-being and achieve their financial goals.

Information

Version

2.0.24

Release date

Aug 04 2024

File size

30.5 MB

Category

Business

Requires Android

7.0+ (Nougat)

Developer

Tata Capital

Installs

0

ID

com.tatacapital.moneyfy

Available on

Related Articles

-

What time does Dune: Awakening release in early access?

Dune: Awakening is out this week on Windows PC, following a delay from its initially planned May 20 release date. The survival game purports to inject fresh spice both into the survival genre and into1 READS

Jun 04 2025

-

All skins in Elden Ring Nightreign and how to unlock them

Skins in Elden Ring Nightreign are officially called “garb” — it’s the game’s version of cosmetics or alternate outfits for its cast of playable classes. As you continue your journey against the eight1 READS

Jun 04 2025

-

How the Pokémon Go Pass June works and should you buy premium?

After a few months of testing, Pokémon Go’s monthly “Go Pass” is out globally for everyone to try. It’s similar to the pass we saw as part of the Unova Tour, with a few differences, but it is a battle1 READS

Jun 04 2025

-

Elden Ring fans find Nightreign item secret so good it sounds like a glitch

I can’t be the only one who has run by boluses in Elden Ring Nightreign without a second thought, or thrown the balls away in favor of items that seem more immediately useful. Why waste a slot? I’ve b1 READS

Jun 03 2025