Optum Bank

Description

The Optum Bank app helps you get more out of your health account benefits. You’ll get clear tips on stretching every dollar. Plus, we’ll help you understand how to make your health savings account, flexible spending account or other spending accounts work harder for you.

WITH THE APP UPDATE, YOU CAN NOW EASILY:

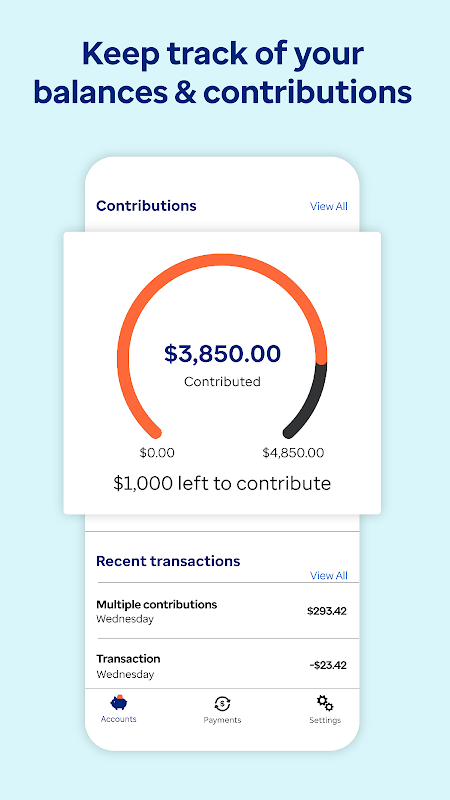

Keep track of all your account balances

Unlock more ways to use your health account dollars

Use your account to pay for health costs

Find answers if you have questions

Store your health care receipts all in one place

Understand what may qualify as an eligible health expense

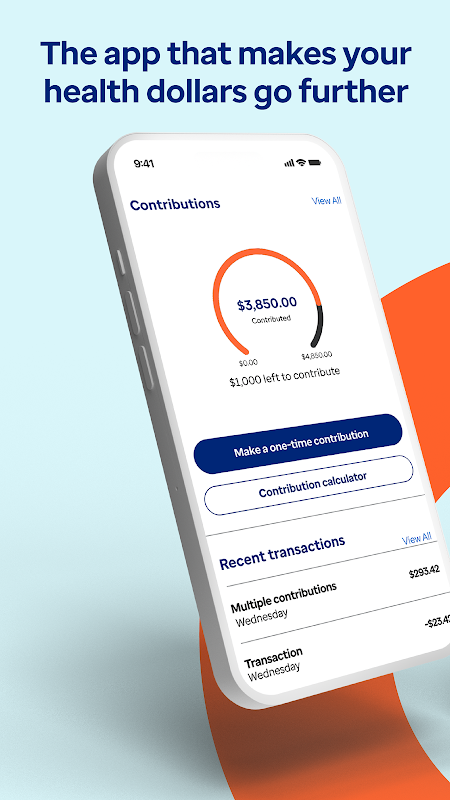

VIEW YOUR HEALTH ACCOUNTS FROM ANYWHERE

See your health account balances and contributions and view health spending and saving transactions all in one place.

DID SOMEONE SAY SHOPPING? YES, WE DID.

Get more out of your health dollars and understand what health costs are eligible (think allergy meds, acupuncture and thousands more). Then shop and pay with your Optum card or digital wallet.

PAY BILLS, PAY EASILY, PAY YOURSELF

Pay for health-related expenses, check and submit claims for reimbursement and easily capture receipts, all with a few taps.

AND IF YOU HAVE QUESTIONS, WE HAVE ANSWERS

Easily find out what you need or type away and send us an email.

ACCESS INSTRUCTIONS:

You will need to have an Optum Bank health account to use this app. Please visit optumbank.com if you’re an Optum Bank customer and need to update your account credentials.

ABOUT OPTUM BANK:

Optum Bank is advancing care, connecting the worlds of health and finance in ways that no one else can. Optum Bank is a leading health accounts administrator with over $19.8B in customer assets under management. By developing proprietary technology and applying advanced analytics in new ways, Optum Bank helps reduce costs while helping people make better health decisions — creating a better health care experience for our customers.

Optum Bank, a leading financial institution, offers a wide range of banking and investment services to individuals, businesses, and institutions. With a focus on providing personalized financial solutions, Optum Bank leverages its expertise and innovative technology to empower its clients with financial success.

Core Banking Services

Optum Bank's core banking services include checking and savings accounts, debit and credit cards, and personal loans. Its checking accounts provide convenient access to funds through online and mobile banking, ATMs, and a nationwide network of branches. The bank's savings accounts offer competitive interest rates, enabling clients to grow their savings over time.

Investment Solutions

Optum Bank's investment division provides a comprehensive suite of investment products and services. Clients can access a wide range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). The bank's experienced financial advisors offer personalized investment advice and portfolio management services, tailored to each client's individual financial goals.

Business Banking

Optum Bank offers a dedicated suite of services for businesses of all sizes. Its business checking and savings accounts provide efficient cash management solutions. The bank also offers commercial loans, lines of credit, and merchant services to support business growth and expansion.

Wealth Management

For high-net-worth individuals and families, Optum Bank provides comprehensive wealth management services. Its team of experienced wealth advisors offers tailored solutions, including estate planning, trust management, and philanthropic guidance. The bank's focus on long-term financial security and preservation of wealth enables clients to achieve their financial aspirations.

Digital Banking

Optum Bank recognizes the importance of digital banking and offers a robust suite of online and mobile banking services. Clients can conveniently manage their accounts, make payments, and access financial information from anywhere, at any time. The bank's mobile app provides a seamless and user-friendly experience, empowering clients with real-time control over their finances.

Customer Service

Optum Bank prides itself on its exceptional customer service. Its dedicated team of customer service representatives is available 24/7 to assist clients with any inquiries or requests. The bank's commitment to providing personalized support ensures that clients receive the highest level of service and attention.

Conclusion

Optum Bank is a trusted and reliable financial institution that offers a comprehensive range of banking and investment services. With its focus on personalized solutions, innovative technology, and exceptional customer service, Optum Bank empowers its clients to achieve their financial goals and build a secure financial future.

Information

Version

2.6.3

Release date

Aug 10 2024

File size

55.00M

Category

Tools

Requires Android

8.1.0+ (Oreo)

Developer

Optum Inc.

Installs

0

ID

com.optum.mobile.OptumBank

Available on

Related Articles

-

What time does Dune: Awakening release in early access?

Dune: Awakening is out this week on Windows PC, following a delay from its initially planned May 20 release date. The survival game purports to inject fresh spice both into the survival genre and into1 READS

Jun 04 2025

-

All skins in Elden Ring Nightreign and how to unlock them

Skins in Elden Ring Nightreign are officially called “garb” — it’s the game’s version of cosmetics or alternate outfits for its cast of playable classes. As you continue your journey against the eight1 READS

Jun 04 2025

-

How the Pokémon Go Pass June works and should you buy premium?

After a few months of testing, Pokémon Go’s monthly “Go Pass” is out globally for everyone to try. It’s similar to the pass we saw as part of the Unova Tour, with a few differences, but it is a battle1 READS

Jun 04 2025

-

Elden Ring fans find Nightreign item secret so good it sounds like a glitch

I can’t be the only one who has run by boluses in Elden Ring Nightreign without a second thought, or thrown the balls away in favor of items that seem more immediately useful. Why waste a slot? I’ve b1 READS

Jun 03 2025