DSP Mutual Fund

Description

Embark on a journey towards smarter MF investing with the DSPMF app- an intuitive companion designed to simplify your investment decisions and help your money fulfil its potential.

Intelligent Portfolio Insights: Effortlessly monitor and manage your portfolio through a tailored dashboard and gain insights into your asset allocation, returns, and actionable recommendations- all powered by advanced analytics, ensuring a guided and optimized investment journey.

Seamless Service Management: Streamline your administrative tasks with ease. Download statements, update account details, nominate beneficiaries, and manage your KYC seamlessly—all within the app's user-friendly interface.

Intelligent Scheme Selection: Navigate the complex world of multiple schemes effortlessly. Leverage our intuitive filters, comprehensive scheme pages, and Sarthi- an AI-driven recommendation engine, to discover funds aligned with your investment goals. Access educational resources and insightful content to enhance your investing prowess.

Effortless Transactions: Experience a frictionless investing experience. Execute transactions with unparalleled ease and receive timely and meaningful nudges that matter, to empower informed decisions, giving you confidence that your financial objectives are on track.

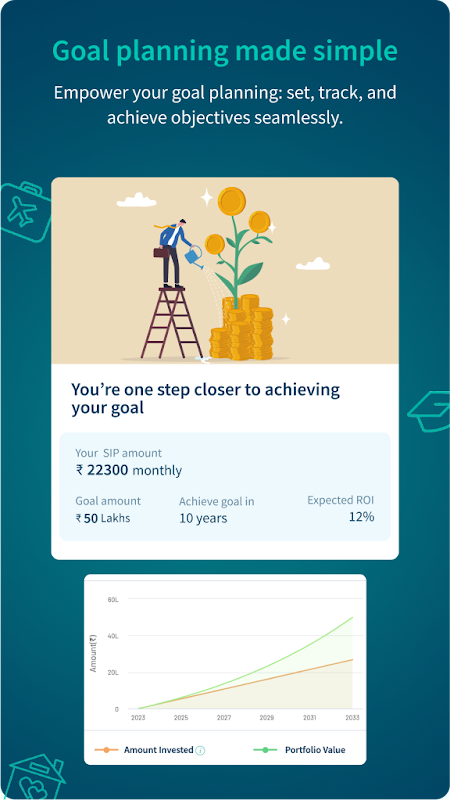

Explore Innovative Features: Unlock a treasure trove of features tailored to elevate your investing experience. From personalized fund recommendations with Sarthi to dynamic goal planning calculators, insightful blogs, and the convenience of our Family Account feature- discover a world of possibilities at your fingertips.

--------------------------

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

DSP Mutual Fund, a prominent player in the Indian asset management landscape, offers a diverse range of investment solutions catering to varied investor profiles and financial goals. Established in 1996 as a joint venture between DSP Group and Merrill Lynch Investment Managers, the company has evolved into a significant entity, managing a substantial corpus of assets across various asset classes. DSP Mutual Fund's investment philosophy emphasizes long-term wealth creation through disciplined investing and a research-driven approach. The company leverages its extensive research capabilities to identify promising investment opportunities across equity, debt, and hybrid asset classes.

DSP Mutual Fund's product offerings encompass a wide spectrum of investment strategies, catering to investors with varying risk appetites and investment horizons. Equity schemes, designed for long-term capital appreciation, invest primarily in stocks of companies across diverse sectors. These schemes range from large-cap funds, focusing on established companies with robust market capitalization, to mid-cap and small-cap funds, targeting companies with higher growth potential. Thematic funds, specializing in specific sectors like infrastructure or technology, offer targeted exposure to particular investment themes. Value funds, on the other hand, seek undervalued companies with strong fundamentals, aiming to capitalize on market inefficiencies.

Debt schemes, emphasizing income generation and capital preservation, invest primarily in fixed-income securities like government bonds, corporate bonds, and money market instruments. These schemes cater to investors seeking stable returns with lower risk compared to equity investments. Income funds, focusing on generating regular income, invest in a portfolio of debt instruments with varying maturities. Short-term funds, designed for short-term parking of surplus funds, invest in highly liquid money market instruments. Dynamic bond funds, actively managing the portfolio duration based on interest rate outlook, aim to optimize returns in varying interest rate environments.

Hybrid schemes, combining equity and debt investments, offer a balanced approach to investing, aiming to achieve both capital appreciation and income generation. Balanced funds maintain a predetermined allocation between equity and debt, providing a moderate level of risk and return. Aggressive hybrid funds allocate a higher proportion to equities, aiming for higher growth potential with moderately higher risk. Conservative hybrid funds, on the other hand, allocate a larger portion to debt, prioritizing capital preservation with moderate growth potential.

DSP Mutual Fund's investment process is underpinned by a robust research framework, encompassing fundamental analysis, quantitative analysis, and technical analysis. The company's research team comprises experienced analysts who meticulously evaluate companies and market trends to identify promising investment opportunities. The investment decisions are guided by a disciplined approach, adhering to well-defined investment strategies and risk management principles.

The company's commitment to investor education and transparency is reflected in its comprehensive investor resources and regular communication updates. DSP Mutual Fund provides detailed information about its schemes, including investment objectives, portfolio holdings, and performance track record, enabling investors to make informed investment decisions. Regular fact sheets, portfolio updates, and market commentaries keep investors abreast of market developments and their investment performance.

DSP Mutual Fund's distribution network spans across various channels, including online platforms, distributors, and financial advisors, ensuring accessibility to investors across different segments. The company's dedicated customer service team provides prompt and efficient support to investors, addressing their queries and concerns.

Over the years, DSP Mutual Fund has garnered several accolades and recognitions for its performance and service excellence. The company's consistent track record of delivering competitive returns and its commitment to investor interests have earned it a strong reputation in the asset management industry.

DSP Mutual Fund's focus on long-term value creation, coupled with its robust investment process and experienced management team, positions it as a reliable partner for investors seeking to achieve their financial goals. The company's diverse product offerings, catering to various investment needs and risk profiles, provide investors with a wide range of options to build a diversified investment portfolio. With its unwavering commitment to investor education and transparency, DSP Mutual Fund empowers investors to make informed decisions and navigate the complexities of the financial markets.

Information

Version

1.0.174

Release date

Sep 16 2024

File size

26.5 MB

Category

Tools

Requires Android

5.1+ (Lollipop)

Developer

DSP Mutual Fund

Installs

0

ID

com.dsp.invest

Available on

Related Articles

-

How to use Virtual Game Cards on the Nintendo Switch 2 and 1

The Nintendo Switch 2 has the Virtual Game Card system, which lets you share your games with friends. (To be clear, the original Nintendo Switch has this too, but you may have seen a notice about it w1 READS

Jun 06 2025

-

Forsaken Fortress walkthrough in Zelda: The Wind Waker

The Forsaken Fortress is the first area (arguably a dungeon on a technicality, but not really) you’ll go to in The Legend of Zelda: The Wind Waker. For many, it’s a terrible memory. You’re forced to u1 READS

Jun 05 2025

-

Dragon Roost Cavern walkthrough in Zelda: The Wind Waker

Dragon Roost Cavern is the first “real” dungeon you’ll complete in The Legend of Zelda: The Wind Waker (not counting the stealthy tutorial of Forsaken Fortress) and it’s where you’ll unlock your first1 READS

Jun 05 2025

-

Forbidden Forest walkthrough in Zelda: The Wind Waker

The Forbidden Forest is the second full dungeon in The Legend of Zelda: The Wind Waker, and it’s where all the bad stuff happens around the Forest Haven. You’ll visit here after Dragon Roost Cavern.Th1 READS

Jun 05 2025