CreditFit

Description

CreditFit: Free Credit Score, Apply for Loans & Credit Cards

With

CreditMantri's CreditFit

app, you can check your free credit score, improve your credit health & get Credit expert's assistance with resolving your unpaid credit accounts. We offer a wide range of loans & credit cards uniquely matched to your profile from top banks & NBFCs. Join

over 20 million+ Indians 🛡️

who trust CreditFit for their financial needs!

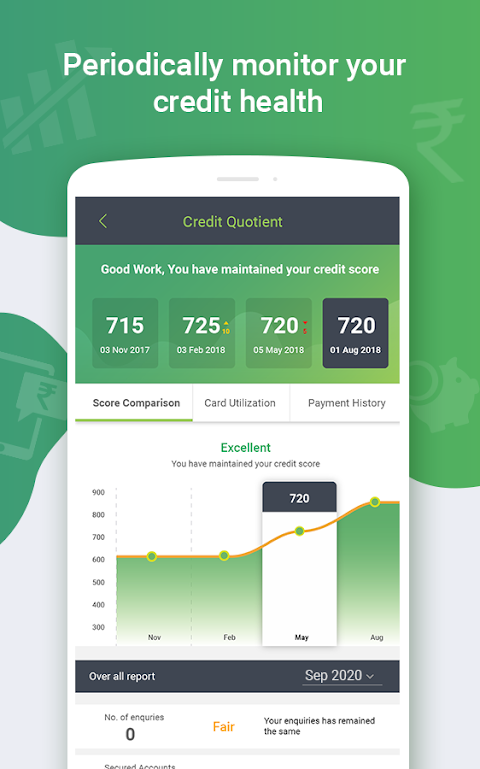

📈 Credit Score & Analysis

• Check your credit score and get an analysis of your credit report for FREE

• Subscribe to our services to understand the factors that affect your credit score and where you stand on all those factors

• Get 12 monthly reports of your credit profile to see how your borrowing behavior is affecting your credit profile

• Subscribe to our CreditFit service for a personalised action plan to improve your Credit health with the assistance of our in-house Credit Expert

• Our Bureau partners are Equifax and CRIF, two major credit bureaus authorized by RBI (the other two being CIBIL and Experian)

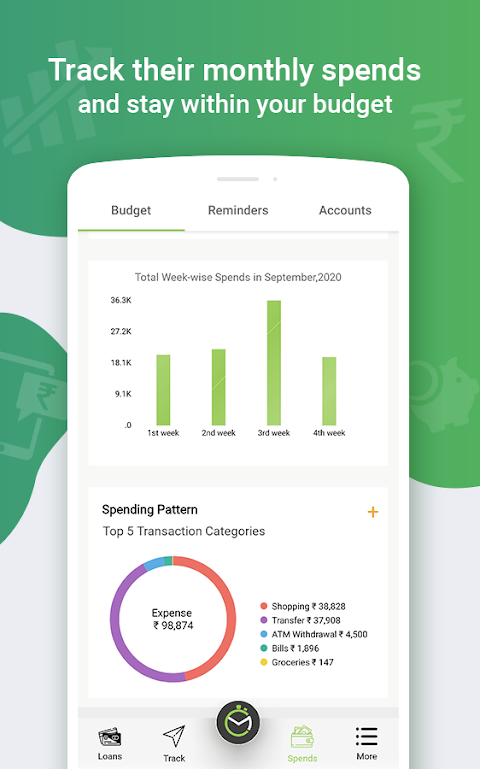

💸 Track your expenses

• Plan your budget & track your spends across categories

• Quickly add cash transactions to accurately track expenses

• Get reminders for EMI & credit card bill payments to ensure timely payments

• Check your bank balance & ATM withdrawal count easily

💸 Loans & Credit Card Offers

• Apply for exclusive loans & credit cards from over 30 leading Banks and NBFCs of India

• Get instant approval on loans & credit cards with zero documentation & flexible EMI options as per your eligibility

• Build your credit score with your first credit product

• Get access to guaranteed loan options when you’re facing loan rejections

💰 What is the loan amount, tenure and interest rate I can get and how to become eligible?

• Personal loan: From Rs.1,000 to Rs.30 lakhs & tenure from 90 days to 5 years & interest rate varies from 11.99% to 35% per annum.

• Maintain a 750+ credit score to become eligible for best loans & Credit cards from 30+ lenders

😇 Why Choose CreditFit?

•

Personalised action plan:

Get a detailed analysis of your credit report via monthly & quarterly reports on your credit behavior with insights & an action plan to improve and maintain your credit health

•

Expert Assistance:

Get expert assistance from our Credit Coach to implement your action plan

•

Free Credit Score:

Check your Equifax & CRIF score instantly for free, with no spam or ads

•

Correct wrong data in your bureau report:

Report inaccuracies like wrong accounts, missed payment details, wrong account status directly to the bureau, through our expert guidance

•

Reduce your EMIs:

Understand if your loans are optimally priced by comparing them with the market rates. Talk to our expert to understand how to reduce your EMIs

•

Negative account resolution:

Get expert assistance on repaying and clean closing your negative accounts

Sample example of the total cost of the loan:

• Loan amount: Rs.1,00,000

• Interest rate(APR): 13% per annum

• Loan tenure: 12 months

• Total interest to be paid: Rs.13,000

• Processing fee + GST: Rs.588 (Rs.499+GST)

• Monthly EMI repayment: Rs.9,466

• Total amount to be repaid: Rs.1,13,588

Major lending Partners:

CreditFit has partnered with leading banks & NBFCs to provide loans

• L&T Finance Limited

• InCred Financial Services Limited

• Shriram Finance Limited

📞 Contact Us

• For any queries, email us at [email protected] or visit our CreditMantri's website

📍 Address

CreditMantri Finserve Private Limited Unit No. B2, No 769, Phase-1, Lower Ground Floor, Spencer Plaza, Anna Salai, Chennai - 600002

CreditMantri's CreditFit app is India’s No.1 mobile app for checking Free Credit Score & detailed Credit Analysis. Download CreditFit now to start your journey towards better credit health & access to the best financial products

CreditFit is an innovative financial wellness platform designed to empower individuals in managing their credit and achieving financial stability. It offers a suite of personalized tools and expert guidance to help users improve their credit scores, reduce debt, and build a strong financial foundation.

Personalized Credit Analysis

CreditFit begins by providing a comprehensive credit analysis that assesses users' credit reports from all three major credit bureaus (Experian, Equifax, and TransUnion). This analysis identifies areas for improvement and provides personalized recommendations tailored to each user's unique financial situation.

Credit Score Improvement

CreditFit's credit score improvement module guides users through a step-by-step process to increase their credit scores. It offers insights into credit utilization, payment history, credit mix, and inquiries, empowering users to make informed decisions that positively impact their creditworthiness.

Debt Reduction Strategies

CreditFit provides a comprehensive debt reduction plan that helps users prioritize and manage their debts effectively. It offers budgeting tools, debt consolidation options, and personalized recommendations to minimize interest payments and accelerate debt repayment.

Financial Education and Support

CreditFit recognizes the importance of financial literacy and provides a wealth of educational resources to its users. Articles, videos, and webinars cover topics such as credit basics, budgeting, and investment strategies. Additionally, users have access to certified financial counselors for personalized guidance and support.

Personalized Action Plan

Based on the user's financial goals and analysis, CreditFit creates a personalized action plan that outlines specific steps to improve their credit and overall financial well-being. This plan provides clear guidance and motivation to help users stay on track towards their financial goals.

Secure and Convenient

CreditFit is committed to user privacy and security. It utilizes industry-standard encryption and security measures to protect users' personal and financial information. The platform is also accessible 24/7, allowing users to manage their finances and access support at their convenience.

Benefits of CreditFit

* Improved credit scores

* Reduced debt and interest payments

* Increased financial literacy

* Personalized guidance and support

* Convenient and secure platform

Conclusion

CreditFit is an indispensable financial wellness tool that empowers individuals to take control of their credit and achieve financial stability. Its personalized approach, comprehensive resources, and expert guidance provide users with the knowledge, tools, and support they need to improve their financial well-being and reach their financial goals.

Information

Version

4.2.1

Release date

Jul 29 2024

File size

38 MB

Category

Tools

Requires Android

10+ (Android10)

Developer

CreditMantri Finserve Private Limited

Installs

0

ID

com.creditmantri

Available on

Related Articles

-

Lies of P How to Start Overture DLC

Lies of P: Overture DLC is a prequel to the main game. It is a paid DLC that needs to be purchased first, available for $29.99 / €29.99.Step 1: Beat Corrupted Parade Master Boss in Main Game to obtain1 READS

Jun 08 2025

-

How to rewind in Mario Kart World

Mario Kart World’s rewind feature is quietly one of the racing game’s most useful features for learning how its new tricks, jumps, and grinds work. The Nintendo Switch 2 launch game sets you loose to1 READS

Jun 08 2025

-

How to unlock Rainbow Road in Mario Kart World

The tracks in Mario Kart Word are the real stars in the game and the shiniest one is the Rainbow Road track. The mesmerizingly colorful track is something out of this world — literally. Unlike all the1 READS

Jun 07 2025

-

Pokémon Go ‘Instrumental Wonders’ event guide

Pokémon Go is continuing its hype lead-up to the yearly Go Fest event with the “Instrumental Wonders” event that runs from June 7-11.This event encourages players to raid, with the main perk of this e1 READS

Jun 07 2025