Intuit Credit Karma

Description

Get everything you need to outsmart the system with Intuit Credit Karma:

• Insights: View all your linked accounts in one place and uncover new ways to improve your finances.

• Free credit monitoring – Get alerted when your score changes, learn what affects your credit scores and get tips on how to improve.

• Advanced Cards and Loan Marketplace: You can find the best credit card and personal loan offers for you and see the specific credit limits, exact loan amounts and rates you could get approved for.

• Net Worth: Track your net worth, monitor your categorized monthly cash flow, find opportunities to save money and learn how to navigate complex financial decisions.

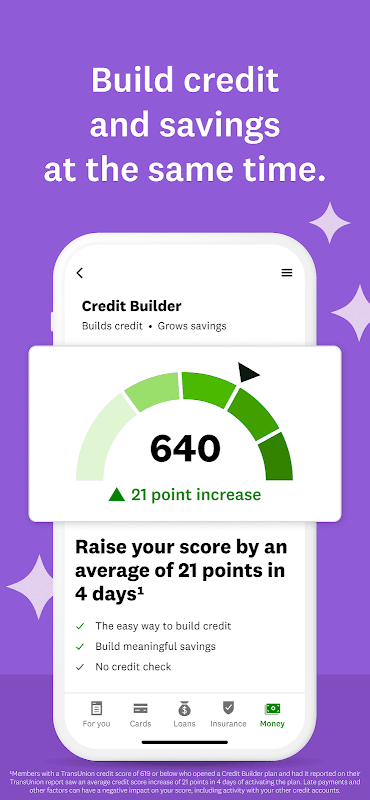

• Credit Builder*: Boost a low score by an average of 21 points in 4 days.*

• Checking: Direct deposit your paycheck into your Credit Karma Money SpendTM account*** and you could access your paycheck up to two days earlier.****

• Drive Score: With a good drive score, you could save big on car insurance from a nationally trusted provider.

And much, much more. Just simply download the app to get started.

DISCLOSURES

*Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply per account. Credit Builder is not provided by MVB Bank.

**A connected paycheck or one time direct deposit of $750 is required for activation. Credit Builder plan is serviced by Credit Karma Credit Builder and requires a line of credit and savings account provided by Cross River Bank, Member FDIC. Members with a TransUnion credit score of 619 or below who opened a Credit Builder plan and had it reported on their TransUnion report saw an average credit score increase of 21 points in 4 days of activating the plan.

***Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply.

****Early access to paycheck is compared to standard payroll electronic deposit and is dependent on and subject to payor submitting payroll information to the bank before release date. Payor may not submit paycheck early.

Some screen images are simulated.

Loan services offered through Credit Karma Offers, Inc., NMLS ID# 1628077 | Read licenses at https://www.creditkarma.com/about/loan-licenses | California loans arranged pursuant to a California Financing Law license.

Insurance services offered through Karma Insurance Services, LLC. CA resident license #0172748.

ELIGIBILITY AND ADDITIONAL DETAILS; PERSONAL LOAN INTEREST RATES AND FEES. You can see personal loan offers on the Credit Karma personal loan marketplace from third party advertisers from which Credit Karma receives compensation. Credit Karma members are shown offers with Outstanding Approval Odds** when available to them. Offers with Outstanding Approval Odds have rates that range from 4.97% APR to 35.99% APR with terms from 1 to 10 years. Rates are subject to change without notice and are controlled by our third party advertisers, not Credit Karma. Depending on the particular lender, other fees may apply, such as origination fees or late payment fees. See the particular lender’s terms and conditions for additional details. All loan offers on Credit Karma require your application and approval by the lender. You may not qualify for a personal loan at all or you may not qualify for the lowest rates or the highest offer amounts.

PERSONAL LOAN REPAYMENT EXAMPLE. The following example assumes a $15,000 personal loan with a four year (48 month) term. For APRs ranging from 4.97% to 35.99%, monthly payments would range from $345 to $593. Assuming all of the 48 payments are made on-time, the total amount paid would range from $16,571 to $28,491.

Overview

Intuit Credit Karma is a free personal finance platform that offers a suite of tools and services to help users manage their credit, track their spending, and save money. The platform is powered by TransUnion and Equifax, two of the three major credit bureaus in the United States.

Key Features

* Free Credit Monitoring: Credit Karma provides free access to your credit reports and scores from TransUnion and Equifax. You can track your credit history over time and see how it is impacting your creditworthiness.

* Spending Tracker: The Spending Tracker feature allows you to connect your bank accounts and credit cards to Credit Karma. This will give you a comprehensive view of your spending habits and help you identify areas where you can save money.

* Budgeting Tools: Credit Karma offers a variety of budgeting tools to help you create and track your budget. You can set up automatic savings goals, track your progress towards financial goals, and receive alerts when you are overspending.

* Loan and Credit Card Marketplace: Credit Karma provides access to a marketplace where you can compare loan and credit card offers from multiple lenders. This can help you find the best rates and terms on new loans and credit cards.

* Tax Preparation: Credit Karma offers a free tax preparation service that can help you file your taxes online. The service is powered by TurboTax and provides step-by-step guidance to help you maximize your refund.

Benefits of Using Credit Karma

There are many benefits to using Credit Karma, including:

* Improve Your Credit Score: Credit Karma can help you improve your credit score by providing you with access to your credit reports and scores. You can track your progress over time and see how your actions are impacting your creditworthiness.

* Save Money: Credit Karma can help you save money by providing you with tools to track your spending and create a budget. You can also compare loan and credit card offers to find the best rates and terms.

* Simplify Your Finances: Credit Karma can help you simplify your finances by providing you with a single platform to manage your credit, track your spending, and prepare your taxes.

Who Should Use Credit Karma?

Credit Karma is a great option for anyone who wants to improve their financial health. The platform is especially beneficial for people who are new to credit or who have poor credit. Credit Karma can help you understand your credit report, build your credit score, and make better financial decisions.

Conclusion

Intuit Credit Karma is a valuable personal finance tool that can help you improve your credit, track your spending, and save money. The platform is easy to use and provides a comprehensive suite of tools and services. If you are looking for a way to improve your financial health, Credit Karma is a great option.

Information

Version

24.32

Release date

Aug 05 2024

File size

26.50M

Category

Tools

Requires Android

10+ (Android10)

Developer

EMS+

Installs

18

ID

com.creditkarma.mobile

Available on

Related Articles

-

Introduction to the download and installation tutorial of "Figurine Store Simulator"

Figure Shop Simulator is an interesting and detailed business simulation game developed and produced by Gnome Games. It is quite troublesome to download this game. The first step to download is to install the Steam platform, register an account to log in, and search for "Figure Shop Simulator", then click to buy, and then click to start playing immediately. How to download the "Figurine Store Simulator" to download the "Figurine Store Simulator" and you can choose the Steam platform and 3DM platform. Stea1 READS

May 13 2025

-

Introduction to the method of fighting the mountain protection formation in "Sections"

The mountain protection formation in "Sections" is a special formation in the game, and it is not difficult to fight the mountain protection formation. First of all, the probability of the land-attribute passive skill attack is bleeding. If it is not upgraded, it seems that it will drop 2% once. The attack method of opening a level A and interspersing a normal attack can increase the attack speed by 30. How to hit the ground attribute passive skill array of sects, the probability of bleeding is bleeding. If it is not upgraded, it seems to drop 2% once. The attack method of opening A and interspersed with normal attack can add 30 attack speed. The default displacement is given 500 shields at a time. The attack of the formation is a circle and the CD is longer than the displacement. The golden elixir is chopped by the core formation of the Nascent Soul to lose more than 500 blood at a time. I am optimistic about the opportunity to open the position.1 READS

May 13 2025

-

Introduction to game configuration requirements of "Figurine Store Simulator"

Figure Shop Simulator is an interesting and detailed business simulation game developed and produced by Gnome Games. The graphics of the game are very good, and the configuration requirements are not high. At the lowest CPU, only Intel's Core i5 3550 or AMD's Ryzen 5 2500X processor is required. What configuration is required for the figure store emulator? Minimum configuration: Operating system: Windows (64-bit) 10 processor: i5 3550 / RYZEN 51 READS

May 13 2025

-

Introduction to the game configuration requirements of "Book of Abominations"

Book of Abominations is a monster collection role-playing game produced and released by Studio Catloaf. The graphics of the game are very good, and the configuration requirements are not high. At the lowest CPU, only Intel's Core i3 or AMD's processor of the same level is required. What configuration is required for Book of Abominations Minimum configuration: Operating system: Windows 10 or higher processor: Core i3 or equivalent memory: 1 GB1 READS

May 13 2025